As the Canada Revenue Agency (CRA) begins to process tax refunds, tax scammers also start working on ways to scam taxpayers since it is easier to convince the taxpayer and make them fall for the bait during this period.

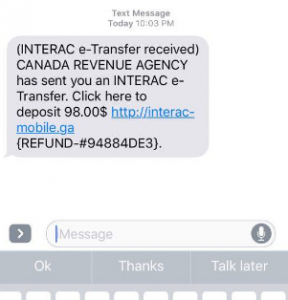

Currently, along with the various tax frauds involving refund mail and tax due payments, the following refund text message has surfaced.

It looks real, BUT IT’S NOT!

Clicking on the provided link will take you to the fake website, where you would need to enter your bank account login details to process the said refund. However, in reality you would simply be providing the scammers access to your account. Possibly, to more than one account if you have kept the login details the same for most of your financial accounts.

With that being said, when it comes to communication from the CRA, there are certain points to keep in mind to identify whether the message, mail or phone call is actually from the CRA or not.

In this article, AGT professionals have highlighted some important checkpoints to consider before proceeding with the action mentioned in the mail, message, or phone call.

Checklist for Identifying A Tax Scam Call, Message or Mail

Time Frame Within Which To Expect Tax Refund

Depending on when and how you filed your tax return will determine the length of time it takes the CRA to process your income tax return and determine your refund or additional tax payment. Paper filed returns normally take between 4 to 6 weeks while e-filing takes at least 2 weeks – so if you paper-filed your tax return on April 15, and expect a refund, wait until mid-May for the refund. The CRA will likely not communicate in any form regarding the tax refund before this period.

CRA My Account, Business Account & Represent A Client Option

If you receive a call, message, or e-mail, asking you to click a website link to process a refund or make certain payments you owe to the CRA you can check your CRA tax account in case. All your tax-related information will be available on your CRA ‘My Account’ page and ‘MyCRA’ mobile application, whether it isregarding tax refund, payment, or tax assessment.

If you have signed up for online mail through CRA’s My Account, My Business Account, or Represent a Client, and taken the necessary steps to confirm your e-mail address and other contact details, a notification e-mail will automatically be sent to the provided e-mail address when there is a new message in your tax account.

Direct Deposit for Canadian Tax Refunds

Currently, the Government of Canada is switching to direct deposit for all payments that it issues, whether it is tax refunds, Canada child benefits, GST credits, and/or disability benefits. Direct deposits ensures security and is highly convenient. The taxpayer does not need to click on any links to process a tax refund. You can sign up Online, with the Mobile app, by phone or by completing a direct deposit form and mailing it to the CRA.

If a Canadian taxpayer has signed up for CRA’s direct deposit option, and provided the required bank account information, the CRA will directly deposit all payments deposited to the taxpayer’s bank account. Therefore, if you receive an email or text message, asking you to click on a link in order to process your tax refund, it is likely a tax scam.

Do not forget to inform the CRA if you close a bank account linked to your tax account, and update them with the latest information.

Canadian Tax Payments

As mentioned above if you owe money to the CRA, details about this should appear on your CRA ‘My Account’ webpage. The CRA will never do the following:

- send an e-mail with a link asking a taxpayer to divulge personal or financial information,

- request immediate payments through prepaid or credit cards, which if not complied with could lead to drastic consequences,

- give taxpayer’s information to another person, unless the taxpayer formally authorizes to do so, or

- leave personal information on an answering machine.

Questions To Ask Yourself

Tax scammers are masters of their con. They use professional language, and often mention few details that may convince one of the possible tax refund or tax due. Remember that the scammer has cone significant research on you before calling or mailing you.

Nonetheless, ask yourself these following questions before complying with the mail or call:

- Have I signed up to receive online mail through CRA’s My Account, My Business Account, or Represent a Client?

- Did I provide my email address on my income tax and benefit return to receive mail online?

- Was there any money expected from the CRA for any current or previous tax years?

- Have I already received my refund and/or notice of assessment?

- Did I miss reporting the mentioned income, or make the said error in my current or previous tax returns?

- Is the requested information related or in any way relevant to my tax return?

- Would CRA already have this information on file for me?

Never provide personal information through the Internet or by email. The CRA does not ask you to provide personal information by email. Keep your access codes, user ID, passwords, and PINs secret. Be careful before you click on links in any email you receive. Some criminals may be using a technique known as phishing to steal your personal information when you click on the link. Protect your social insurance number. Don’t use it as a piece of ID and never reveal it to anyone unless you are certain the person asking for it is legally entitled to that information. If an organization asks for your social insurance number, ask if it is legally required to collect it, and if not, offer other forms of ID.

No matter what the e-mail or message states, or the person over the phone says, always remember the CRA will not require any taxpayer to make immediate payments. If a taxpayer has a tax debt and cannot pay in full, the CRA offers various instalment payment options. If someone claims to be a CRA agent and offers to provide assistance to get the tax debt reduced or cleared on the payment of some fee, do not fall for it. Reach out to the CRA and inquire if the particular agent exists and if such debt reductions are possible.

If a charitable organization asks for donation promising a significant tax deduction, do not comply immediately. First, verify whether the organization is a CRA qualifying charity or not at www.cra.gc.ca/charities . Secondly, remember that there is a limit to the deduction that the taxpayer may claim, which does not change in any situation.

Always remember if something sounds too good to be true, it probably is. Last but not the least, if in doubt and for some reason you are not comfortable talking to the CRA, it is highly recommended to consult a tax practitioner about your tax situation, and the mails, messages and/or calls that you have been receiving.

AG TAX LLP CAN HELP

If you have any tax-related queries, need assistance with tax planning or filing your tax returns please contact us. Our team comprises of highly experienced tax professionals with extensive knowledge of US and Canadian tax laws as well as cross-border compliance.

Furthermore, as a full service accounting firm, AG Tax assures complete assistance with even your most complex tax needs.

We can assist with:

- Canadian Personal and corporate tax returns

- Cross Border Taxation and Business Planning

- US Personal and Corporate Taxation

- Disclosure of Foreign Assets and other information filings

- Retirement planning

- Estate Planning, Inheritance tax advice

To obtain a quote or to arrange for a consultation to discuss your tax related queries, please contact us at:

- 604-538-8735 (Greater Vancouver Area, BC)

- 780-702-2732 (Greater Edmonton Area, AB)

Disclaimer: The information in this publication is accurate as of the time of its publication. AG Tax assumes no responsibility for changes to tax legislation subsequent to the publication of this document. The information provided is for general information purposes only and should not be acted upon without seeking professional advice. If you would like to engage our services, please contact our staff and obtain authorization to send our firm confidential information. A client relationship is not created by the transmission of information. A client relationship is only formed with our firm when a scope and engagement letter signed by the firm and the potential client detailing the terms of engagement is present.